As shown in earlier newsletters, a rise in influencer distrust has lowered receptivity to paid endorsements. In parallel, owned content (i.e., posts from brand accounts) also faces tough crowds since it is seen as biased.

At the other end of the trust spectrum, social comments and organic earned posts rule because they satisfy a growing appetite for “independent information.”

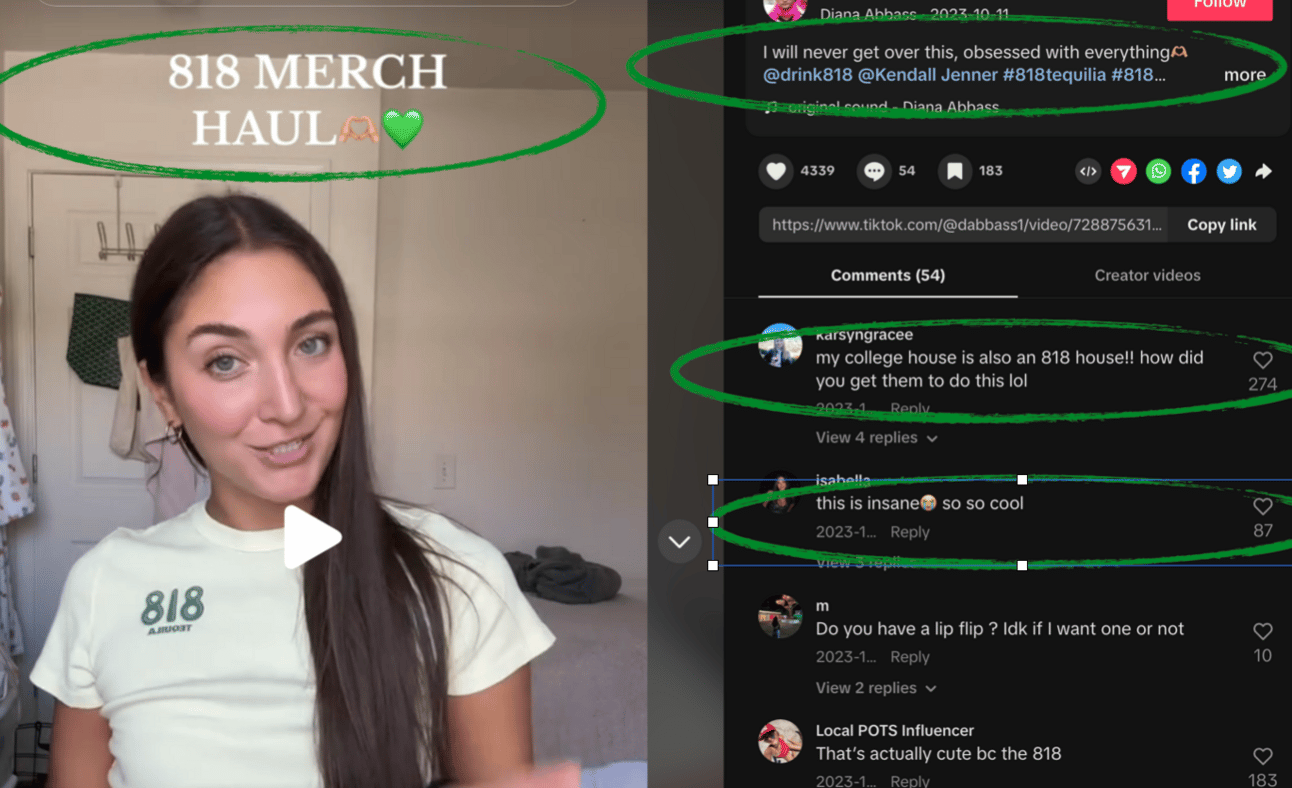

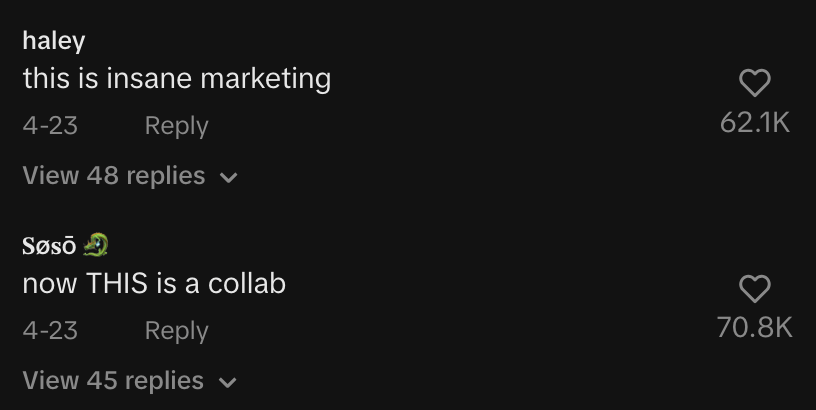

Because it is organic, this type of activity can appear anywhere, including on platforms where some brands are not allowed to post or spend on. For example, many alcohol drinks brands (not allowed to invest on TikTok) end up with a larger footprint on TikTok than on platforms they are allowed to invest in.

How does this even happen, and what does it say more broadly about social dynamics in 2024?

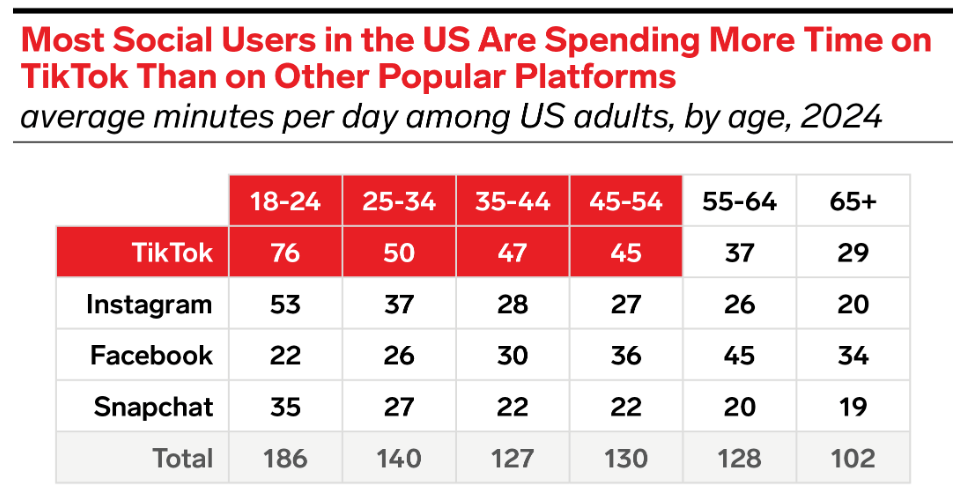

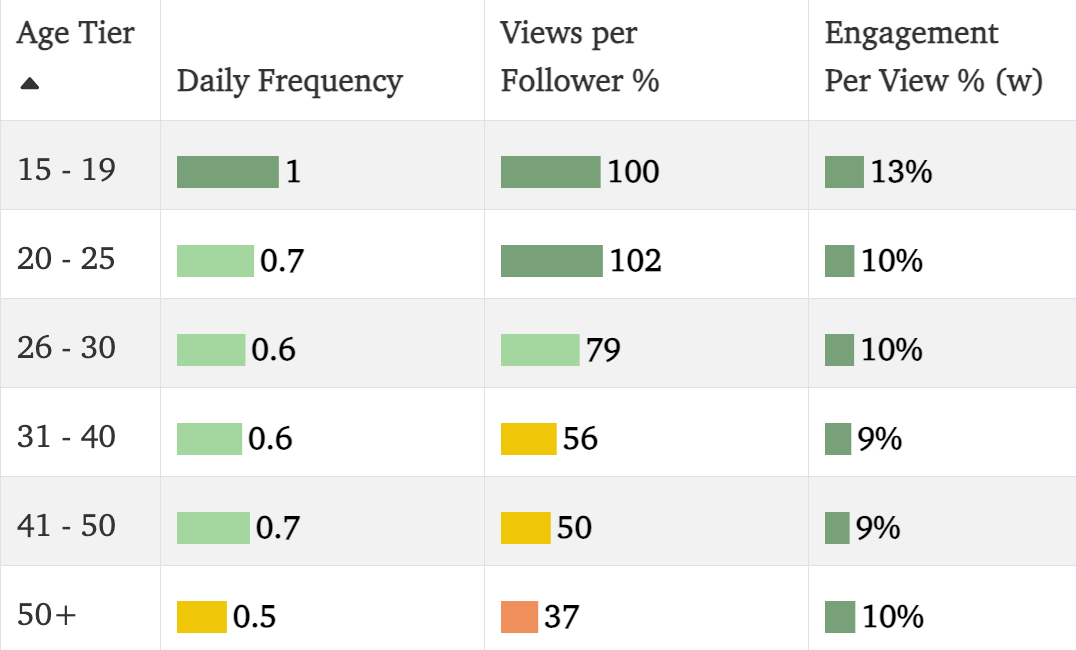

Part of this rise in organic earned comes down to platform size, user age mix, and dynamics: TikTok users are young(er), younger users tend to post more, their content is more engaging, and the platform allows even smaller accounts to go viral. So, even a tiny fraction of a long-tail of UGC posts adds up to a lot of engagement.

Source eMarketer, Feb 2024

Creator activity by age group on TikTok: younger creators post more, more frequently go viral (views per follower) and post more engaging content (Rethink x Social data)

Of course, brands with consumers in their twenties (e.g. Jagermeister, Seltzer brands etc.) will receive more organic activity regardless of their marketing mix. But investment decisions and execution can also have a huge impact on the amount of organic earned a brand receives: does it invest in activities with potential for a second life on social? Do these activities grow trial? Encourage consumer participation (IRL or via #posts)?

Here are some of the factors brands should keep in mind if they want to see their organic earned balloon:

Building a strong “community spirit” with off-line activity, e.g. Dr. Pepper has done this very well in all communications including TV over the years

Active community management and frequent interactions with consumer content initiates more 2-way convos and posts

Last, of course the types of activities matter (merch, collabs, PR, outdoor ads, events, samples etc.) as well as their implementation. Also see our case study on the rhode iPhone lip case.

To maximise their social footprint, all brands ought to expand their playbook from their current 2-pillar approach (paid earned and owned content) to also incorporate off-social activities designed to be talked about on social. For alcohol brands, this expansion is a game-changer as it opens the door to being legally featured on TikTok.

About the author: 20+ years experience in insights & marketing mix at P&G, marketing & media consultancy at McKinsey, head of Europe at L2, co-founder at eBench and Rethink x Social. Have worked with over 250 clients teams across 100+ companies in a dozen categories.

About Rethink x Social: we’re a boutique marketing consultancy, backed by our proprietary tool that tracks and analyses hundreds of thousands of accounts, surfacing insights on trends, best practices, category leaders, and content excellence. We help clients on everything from investment priorities to social strategies. Our most recent R&D emphasis has been on video content codes, tackling tone of voice, storytelling/editing/pacing principles, the roles of subtext, sounds, protagonists, content big ideas.