Sol de Janeiro’s CEO confirmed what Google Trends and website traffic data have been telling us for a while: the brand is on a tear, grew 174% in the 6 months to Sep. 30 ‘23. In fact, search growth accelerated since, putting the brand on pace to achieve est. annual sales over $2B in 2024.

SDJ revenues in 2024 may surpass $2B, double that of L’Occitane, whose “mother” Groupe acquired SDJ in 2021

Likewise, site traffic grew another 30% since December ⬇️. This is impressive for a heavily gifted brand, but this sustained growth pattern is common among brands with strong organic earned — why?

SDJ’s social-led purchases one quarter lead to more UGC content the next

A consumer’s Nov-Dec purchases become the raw material for their Jan-Feb UGC, more so if they were themselves influenced to buy by organic earned posts. 🌀

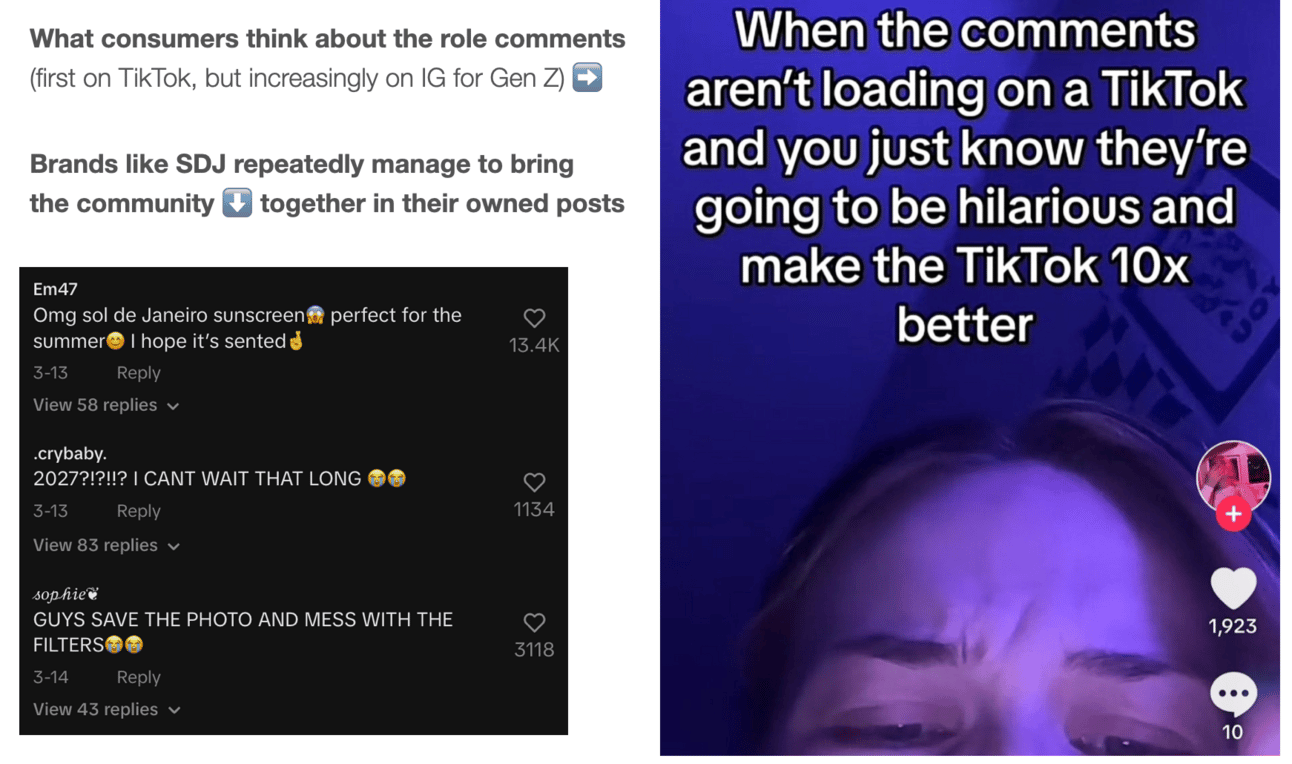

UGC & the comments it elicits are what brings consumers closer together…and to the brand. On top, surveys show these UGC posts overcome the #1 barrier to purchase because they are “independent”:

Paid Earned is less impactful today, while demand for “independent” earned is on the rise: it comes in the form of posts and comments

In line with our analyses, SDJ’s CEO confirmed that 90% of their growth had come from social media, and that it had been organic:

Dec 19 2023 — The article doesn’t go into the how, which is where this newsletter comes in.

Case studies dissecting the dynamics behind success stories like SDJ or Jean Paul Gaultier are surprisingly rare given how powerful and cost effective they are. Maybe it’s because many stakeholders would lose out if more brands experimented and succeeded with a more organic model…

So what is it that SDJ gets right? (from least to most important)

👯 Made-for-Gen Z line-ups of products (colourful, affordable, nice packaging etc.) grow odds of success on TikTok*

📦 Frequent product news multiply UGC opportunities (hauls, unboxings, collections, reviews, layering ideas, etc.)

✅ A creative owned content strategy places SDJ in the top 1% of brands — on both TikTok and Instagram

🎊 Off-social activities multiply opportunities for UGC: all this UGC helps nudge considerers close to purchase (if so many people post about the brand, it must be worthwhile…).

Off-social activities done right feed the organic Earned cycles

🌀The above powers more organic earned, adding fuel to the virtuous cycles

Owned and Paid Earned inject velocity to the cycles — but organic earned activity is the primary engine behind these cycles

SDJ’s social strategy is as well-crafted as they come, more well-rounded and sustainable than even Jean Paul Gaultier’s.

Far removed from the dated social strategy templates that still dominate today, a version of this playbook is used by most fast growing brands (rhode, The Ordinary, Gisou, Carolina Herrera, Glow Recipe, Drunk Elephant etc.).

While each has its own specificities and strengths, the winning formula tends to:

(Re-)embrace owned content creativity to achieve vibrant discussions (via emotions, right-brain features): comments are what brings the community together to discuss, advocate, anticipate, post

Comments increasingly matter on Instagram as dual platform consumers import their TikTok content skills and commenting behaviour on other platforms

Invest in more off-social activities that broaden social participation via UGC (samples/minis/advent, merch (e.g. rhode phone case), events etc.)

Broaden online distribution with socially savvy retailers and affiliates (e.g., Jean Paul Gaultier)

Keep working with paid/incentivised influencers, but prioritise creativity over quantity: reward based on deep engagement rather than views, or even follower size

Footnote

*Where this matters is that (i) TikTok captures more user time, (ii) rewards quality rather than size, (iii) draws engaged viewers in the comments, where they can interact with each other. This means even UGC posts from small accounts can go viral and capture a lot of quality viewer time.

About the author: 20+ years experience in insights & marketing mix at P&G, marketing & media consultancy at McKinsey, head of Europe at L2, co-founder at eBench and Rethink x Social. Have worked with over 250 clients teams across 100+ companies in a dozen categories.

About Rethink x Social: we’re a boutique marketing consultancy, backed by our proprietary tool that tracks and analyses hundreds of thousands of accounts, surfacing insights on trends, best practices, category leaders, and content excellence. We help clients on everything from investment priorities, to social strategies. Our most recent R&D emphasis has been on video content codes, tackling tone of voice, storytelling/editing/pacing principles, the roles of subtext, sounds, protagonists, content big ideas.